FLAGSHIP PROGRAM

One on One Coaching

- Advance

- 846 Learners

- Validity: 90 days

- 4.7 Rating

FLAGSHIP PROGRAM

One on One

Coaching

- Advance

- 846 Learners

- Validity: 90 days

Private Mentorship

Tailored guidance for your trading success.

£8,867

What Will You Learn ?

This course is built on real trading experience, not just theory. You’ll learn how the forex market truly works through live examples, practical insights, and step-by-step guidance.

We’ll cover Smart Money Concepts, risk management, and trade execution, all demonstrated with live market sessions so you can see how strategies work in action.

Along the way, you’ll develop the discipline and mindset of a professional trader, gaining the skills and confidence to trade independently in real conditions.

Module - 1

Introduction and basics

- Opportunities with prop trading firms?

- How prop trading can make you rich?

- How do prop firms make money?

- Case studies

Types of Prop Firm Models

- Evaluation vs Instant funding models

- 1-Step vs 2-Step challenges — which is better?

- Why its better to avoid 3-Step Challenges?

- How to select the best prop firm that fits your need?

Prop Firm Rules & abbreviations

- Static vs Trailing Drawdown

- Consistency rule of prop firms

- What is Maximum Daily Drawdown?

- What is Maximum Overall Drawdown?

- IP Restrictions

- Inactivity Period

- Understanding the Profit Targets

- Why do some prop firms restrict Hedging?

- Expert Advisors (EAs) vs Prop firm rule

- News Trading Rules

- Maximum Open Trades mean in prop firm rules?

- Market Rollover holding restrictions

- Why (KYC) is verified before payouts?

- What is Profit Split?

Psychology of Prop Challenges

- Why most traders fail funding programs

- Building a fail proof trading system

- Pressure vs discipline — managing emotions under rules

- Building realistic expectations before starting

Activities:

- Compare funding models across 5 major firms

- Identify hidden rules that can cause failure

Module - 2

Peak and Low Structures

- 3 exclusive peak structures

- 3 exclusive Low structures

Neckline of M & W and Kill Zone

Price Manipulation

- Sellers side liquidity

- Buyers liquidity

- Support & resistance manipulation

- Breakout & pullback manipulation

Reversal Timing and Pairs

Retailers Trend vs Manipulators Trend

Market Makers Blueprint

The Real Market Cycle

- Explanation of Bear and Bull Cycle

- Explanation of full cycle and sample charts

- Level count and variations

Multi Timeframe Analysis

Activities:

- Identifying full market cycle

- Identifying W-V-V-M / M-A-A-W

Module - 3

Market Structure

- What is Market Structure in forex trading?

- Why is Market Structure important for traders?

- Manipulation vs genuine displacement moves

- What is an Impulse Structure and how does it form?

- How do Premium & Discount zones guide entries?

- The concept of Accumulation–Manipulation–Distribution (A-M-D)

Activities:

- Identifying structure shifts and AMD cycles on charts

- Spotting premium vs discount entry levels

Fair Value Gaps (FVG)

- What is a Fair Value Gap (FVG)?

- Why are FVGs important for traders?

- Displacement and its role in creating inefficiencies

- IRL vs ERL (Imbalance Range vs Equilibrium Range Levels)

- What is the Consistency Theory in FVGs?

- Structural gaps aligned with price moves

- iFVG – refined or improved gaps

Activities:

- Marking FVGs in live and historical charts

Liquidity

- What is Liquidity in forex markets?

- Why does price seek liquidity?

- How to use IRL/ERL levels for Daily Bias?

Activities:

- Identifying liquidity sweeps and stop-hunts

- Mapping liquidity levels for daily bias planning

Blocks (Order Flow)

- What are Order Blocks and their types?

- Why are Order Blocks important for trading?

- Manipulation Blocks and how to spot them

- Continuation Blocks vs regular Order Blocks

- What are Breaker Blocks and when do they appear?

- Which Order Blocks should traders avoid?

Activities:

- Spotting valid vs invalid order blocks

- Backtesting trades with breaker and continuation blocks

Time & Price

- What is the relationship between Time and Price?

- Why does timing matter in market movements?

- How does Time-Based Liquidity form?

- What are Killzones and Key Sessions to trade?

Activities:

- Identifying session-based liquidity grabs

- Comparing moves across London, New York, and Asia sessions

Bias

- What is Daily Bias in trading?

- Why is Daily Bias crucial for planning trades?

- How to set Daily Bias using IRL/ERL levels?

- What is Candle Bias and how to use it?

- How to align bias across multiple timeframes?

- How to react when bias shifts mid-session?

Activities:

- Preparing a daily bias plan before market open

- Team exercise: Aligning IRL, ERL, and candle bias for stronger setup

Module - 4

Introduction to Risk Management in Forex

- Risk as a Funded Trader

- Equity and Balance

- Understanding Drawdown and Profit Targets

Activities:

- Case studies on forex traders who succeeded/failed based on risk management

Calculating Risk-Reward Ratios and Position Sizing

- Risk-reward ratio: Setting and evaluating it effectively

- Tools and calculators

- How to Position size?

Activities:

- Practice exercises: Analysing and calculating risk-reward ratios for different trades

How to Overcome any Drawdown?

- When to increase/Decrease risk?

Setting Stop-Loss and Take-Profit Levels

- How to Minimise Risk?

- Types of stop-losses: Fixed, trailing, and volatility-based

- Strategic TP Leveling

- Profit Securing

Activities:

- Setting stop-loss and take-profit levels on different trading platforms

Analysing Market Volatility and Its Impact on Risk

- Developing a personalised trading journal

- Risk Scaling for higher ROI

Psychological Aspects of Risk Management

- Fund Allocation

- Consistent Payout vs One Big Payout

- One Good Trade

Module - 5

Engineering The Master Trading System

Pre-Trade Entry Checklist

Execution Framework: Steps for Short Position

Execution Framework: Steps for Long Position

Profit-Taking & Exit Rules

Handling Open Positions

Dynamic Trade Management

Module - 6

Understanding Payouts

- Monthly vs bi-weekly vs instant payouts

- KYC verification process

- Withdrawal conditions and profit split ratios

- Tax and compliance

Payout Strategies

- When to withdraw vs when to reinvest

- Protecting long-term growth with smart withdrawals

- Avoiding over-dependency on one firm

Scaling Roadmap

- From $10k to $1M in funding: step-by-step scaling

- Diversification across prop firms for security

- Compounding profits vs withdrawing profits

Sustainability & Longevity

- Building a career, not a one-time payout

- Tracking payout performance

Activities:

- > Drafting a personal scaling roadmap

Private Mentorship

Tailored guidance for your trading success.

£8,867

Our Books

PROP FIRM GUIDANCE

Consistent wealth creation is just a few step away.

A complete step-by-step guide to mastering proprietary trading. This book covers everything from understanding prop firms, risk management strategies, and evaluation phases to building a profitable trading career.

Designed for beginners and aspiring traders, it simplifies the process and helps you confidently clear prop firm challenges.

TRADING JOURNAL

Track. Learn. Improve.

The FXM Academy Trading Journal is designed to help traders record every move, analyze performance, and build consistency. By keeping track of trades, strategies, emotions, and outcomes, you gain clarity on what works and what doesn’t. This powerful tool not only sharpens your decision-making but also accelerates your growth as a disciplined and profitable trader.

About the

Principal Trainer

FINANCIAL TRADER & TRAINER

Hi Traders! I’m Indranil, your trainer and lead analyst at FXM Academy. I began my journey as a trader and fund manager but soon found my true passion in mentoring. Since 2019, I’ve been guiding aspiring forex traders worldwide in institutional trading, helping many become consistently profitable and funded.

With over 8 years of experience in the financial markets, I bring both academic and professional expertise. I am a Finance Graduate, CS Finalist, CFA IFP® certified, NISM Research Analyst, and a Level 4 Candidate at CISI UK. These qualifications, along with years of hands-on market experience, allow me to deliver mentorship that is practical, structured, and research-driven.

I’m proud to share that more than 60–70% of my students have become consistently profitable and funded traders. My promise is simple: if you commit to every assignment, stay disciplined, and treat forex like a profession, I’ll guide you step by step to becoming a profitable and funded trader.

Hi Traders! I’m Indranil, your trainer and lead analyst at FXM Academy. I began my journey as a trader and fund manager but soon found my true passion in mentoring. Since 2019, I’ve been guiding aspiring forex traders worldwide in institutional trading, helping many become consistently profitable and funded.

With over 8 years of experience in the financial markets, I bring both academic and professional expertise. I am a Finance Graduate, CS Finalist, CFA IFP® certified, NISM Research Analyst, and a Level 4 Candidate at CISI UK. These qualifications, along with years of hands-on market experience, allow me to deliver mentorship that is practical, structured, and research-driven.

I’m proud to share that more than 60–70% of my students have become consistently profitable and funded traders. My promise is simple: if you commit to every assignment, stay disciplined, and treat forex like a profession, I’ll guide you step by step to becoming a profitable and funded trader.

Become a

FXM Certified Trader

Understand the pillars of fundamental analysis to evaluate stocks effectively.

Conduct industry, economy and SWOT analyses to identify potential investment opportunities.

Gain insights into a company by conducting company analysis and decoding the annual report, balance sheet, profit and loss statement, and cash flow statement.

Evaluate a company’s financials, liquidity, profitability, risk, solvency, efficiency, and fund utilization using efficiency, growth, return, solvency, cash flow, banking, and valuation ratios.

Here

from our students

Bukky Peters

75% ROI within 2 months of learning

She struggled with forex trading for 8+ years until joining Forexmanipulation’s 5-week training. With renewed confidence, she entered live trading, earning 25% first month and 50% second month—totaling 75% growth.

Victor Uniegbe

Managing Funds of $2,40,000 at Audacity Capital

After repeated losses with courses and signals, he discovered FXM Academy. He learned Market makers model, price manipulation, and intraday trading from indranil—which lead him to clear funding challenges and successfully receive payouts.

Manjula Pankhania

Started trading after retirement

After spending thousands of pounds on dierent trading programs, Ms. Manjula was close to giving up. A one-on-one mentorship with Indranil gave her clarity, a step-by-step roadmap, and the confidence she needed.

Bukky Peters

75% ROI within 2 months of learning

She struggled with forex trading for 8+ years until joining Forexmanipulation’s 5-week training. With renewed confidence, she entered live trading, earning 25% first month and 50% second month—totaling 75% growth.

Mukesh Panigrahi

From Struggles to Prop Firm Success

After spending years on youtube, he fnally decided to give it a try with FXM Academy. Under Indranil’s guidance, he learned basics to advanced, then practiced on demo for a few months, then cleared his prop firm challenge and secured funding.

Manjula Pankhania

Started trading after retirement

After spending thousands of pounds on dierent trading programs, Ms. Manjula was close to giving up. A one-on-one mentorship with Indranil gave her clarity, a step-by-step roadmap, and the confidence she needed.

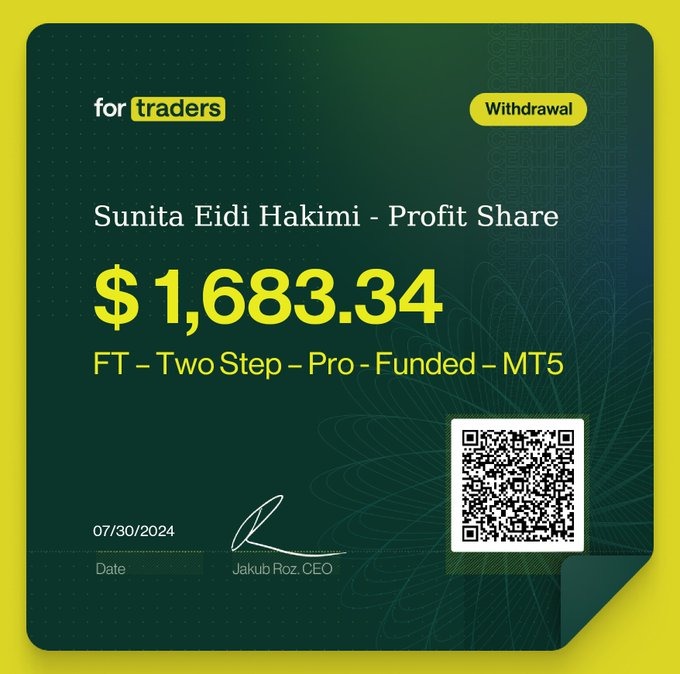

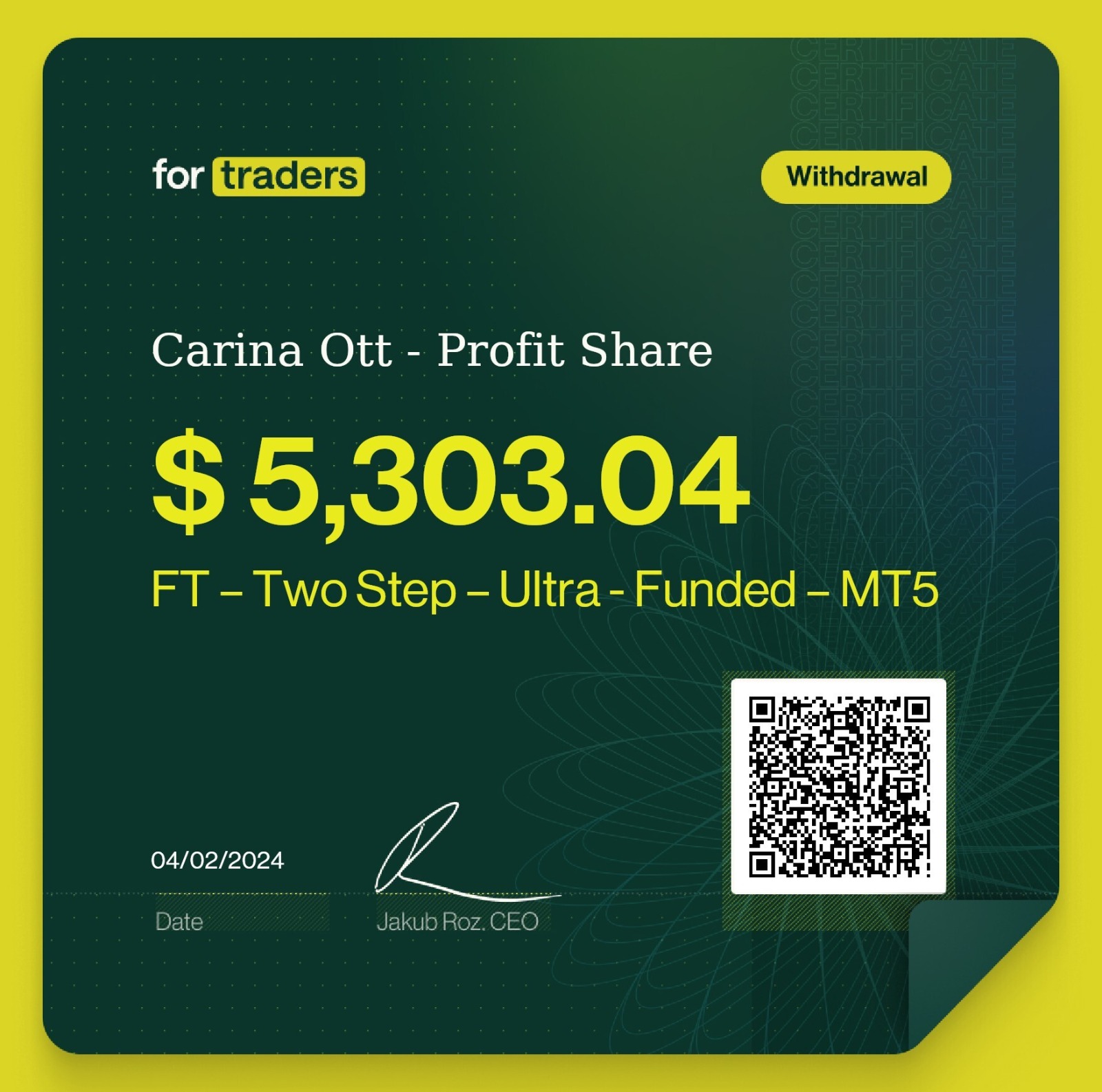

Success Gallery

Why should you choose this program?

Multi-asset Trading Mentorship Program (TMP) is India’s first structured stock market trading program

Institutional Trader Program

Learn what it takes to join the 1%

£1,059

Complete Trader Bundle

From institutional strategy to funding.

£1,467

Private Mentorship

Tailored guidance for your trading success.

£8,867

Other Courses by Abhijit Paul

Discover a range of courses curated by our expert delivering deep insights and expertise on relevant topics.

Technical Analysis for Everyone - Technical Analysis Course

Skills you’ll gain: Momentum Trading, Breakout Trading & more

£1,467

Course FAQ

Yes. FXM Academy is a global trading academy, we accepts students worldwide.

On average, our core programs run for 8 to 12 weeks, followed by 3 months of live trading sessions to ensure you gain hands-on market experience.

You will receive immediate access to our LMS Portal after enrollment. From there, you can start learning with pre-recorded lessons right away, or wait for the upcoming live batch (which starts every quarter). You also have the flexibility to do both — watch recordings and join live sessions.

Yes. We conduct live market sessions where you learn directly while the markets are open.

No worries. Every session is recorded and made available for you to re-watch at any time.

Yes. Generally, you won’t need to attend classes again after completing your course, but if

you wish, you can rejoin any upcoming batch without paying extra fees. This ensures you can

refresh your knowledge whenever needed.

You will have lifetime access to recordings and study materials.

Yes — and it’s mandatory because trading success comes only with practice. But we don’t believe in boring theory-based homework. Instead, you’ll complete 8 hands-on trading tasks such as journaling, demo trades, risk management setups, and live market reviews.

Unlike other academies, we truly care for our students — that’s why every learner is assigned a mentor/accountability partner who reviews your progress, keeps you disciplined, and ensures you build the right habits for long-term trading success.

Yes. You can join from mobile, tablet, or laptop — whichever is convenient

Yes. You will receive structured E-Books, study notes, market guides, and trading templates designed by our mentors.

In live sessions, you can raise your hand and ask questions directly. Plus, you’ll be assigned a mentor with direct contact, so you can reach out anytime for guidance.

Yes. You can refer to our YouTube channel for demo sessions and sample lessons.

We accept PayPal, credit/debit cards, wire transfers, crypto, UPI, and international gateways.

Yes. We provide flexible installment/payment plans for selected courses.

Yes. We have a clear refund policy, details of which are shared during enrollment.

We suggest regulated brokers trusted by professional traders. For personalized guidance, you can connect with our support team.

Our focus is on steady, risk-managed growth. We aim for 10–30% monthly ROI by applying strict 1% risk per trade discipline.

Yes. While our primary focus is forex, the concepts of risk management, price action, and strategy can be applied to other markets like indices, crypto, and commodities.